In response to the Supreme Court blocking the Biden administration’s attempts to offer student debt relief to millions of Americans last June, the admin has moved towards a new plan within the existing loan payment system.

The Saving on Valuable Education (SAVE) plan is a new income driven repayment (IDR) plan that, “provides the lowest monthly payments of any IDR plan available to nearly all student borrowers.” An IDR bases your loan payment off of your monthly income and family size. The SAVE plan is set to replace the Revised Pay As You Earn (REPAYE) plan, the U.S. Department of Education’s (DOE) current loan payment vessel.

The benefits listed within the New SAVE Plan facts document include an increase to the amount of income saved based on the federal poverty guidelines, previously at 150% now up to 225%. This means that individuals who earn $15 an hour won’t have to make monthly payments right away.

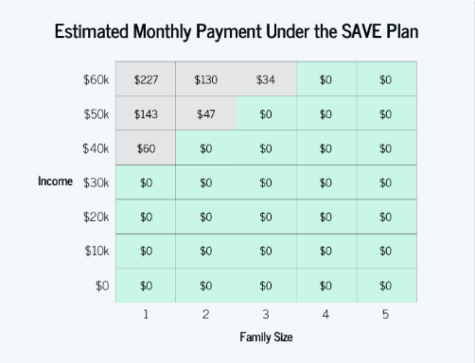

To show the estimated payments, the Federal Student Aid website includes a graph to demonstrate how SAVE would benefit you.

The SAVE facts document also Included the addition that the DOE will no longer charge interest on outstanding payments if you pay your monthly payments in full. As stated, “Borrowers who pay what they owe on this plan will no longer see their loans grow due to unpaid interest.” This will allow debtors to focus on essentials and basic needs before their loans, the SAVE sheet says.

Those already enrolled in REPAYE will automatically be enrolled in SAVE, as the former will be consolidated into SAVE come July of next year. The Federal Student Aid website also states that subsidized loans, unsubsidized loans, PLUS loans and any consolidated loans that were not paid to an individual’s parents are all eligible for SAVE.

Some critics however feel that SAVE, although a better alternative to the current REPAYE system, is only a band-aid solution to a greater problem within the loan payment system. Astra Taylor, an organizer with the Debt Collective, a debtors union that engages in campaigns to address debt reform and cancellation, believes that SAVE isn’t enough.

In an interview with Democracy Now!, Taylor states that SAVE is not a meaningful enough change to a “broken system” by the DOE.

“A few generations ago, public university was free, or close to it, for people who attended…The point is, we’ve seen these fixes before, and they’re not real fixes.”

According to an analytical article by Intelligent, in the 1970s those working minimum wage would have earned double their tuition cost without even having to work during the academic year.

The Debt Collective insists on canceling student debt entirely and restructuring how we view debt forgiveness in the United States. Additionally, they claim to have helped forfeit $800 million in judgment debts and $2 million in medical, student, payday loans and probation debt.

“Debtors have done nothing wrong. We believe that education is a right. People go to college because they’re curious, because they want to have a career that requires certain professional training. This isn’t a crime. This isn’t something that you should need forgiveness for,” Taylor said, explaining why they use language such as “debt cancellation” and not “debt forgiveness.”

Although contested, the SAVE plan is looking to provide more relief than previous IDR’s according to the DOE. And this is only the beginning, as SAVE is implemented over the next year, more provisions and benefits will be included once it is fully implemented on July 1, 2024.

Gaven Mitchell is a third-year History major with a minor in Journalism. GM1001024@wcupa.edu