On Nov. 2 of 2020, my article on the debt of the United States was published on the Quad website, and at that time, the U.S. had a total debt of about $27 trillion dollars. Since my last article, the U.S. debt has grown from $27 to almost $29 trillion dollars. In revisiting this topic, I hope to shine some light on the history of the U.S. and its relationship with debt. In reviewing the nation’s history, we can begin to understand how we got to where we are, and why it is not normal behavior for our country.

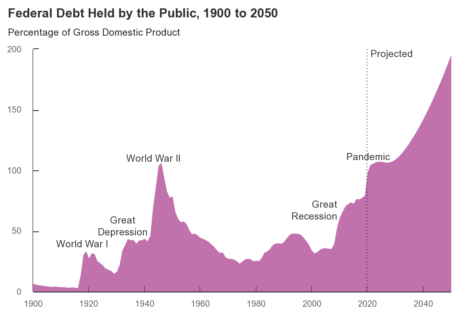

Looking back, the U.S. started with a relatively high Debt-to-GDP ratio — a ratio that compares the amount of debt to the gross domestic product (GDP) of a nation of about 40% due to the $75 million owed from the nation’s war of independence. Such a high debt terrified the founding fathers, as economic instability could have meant the collapse of their young nation. This fear, mixed with financial prowess, led to the only time in U.S. history when there was no debt owed. In 1835, under the guidance of President Andrew Jackson, the United States had paid off its entire national debt. That was so far the only time the U.S. was able to pull off such a feat.

Relatively soon after, the United States was forced to borrow again, almost to the point of bankruptcy. This was brought on by the American Civil War, but because of the same fear and ideals, it wasn’t long before that debt too was paid down to around seven percent.

Then came World War I which, again, raised the Debt-to-GDP ratio, but with victory came the same downtrend of debt payment. That trend, though, was cut short by the great depression, followed by World War II, which brought about an unprecedented ratio of over 100%, with a debt at the time of over $200 billion. Luckily, the end of the second world war brought about stabilization again, as the country quickly brought the Debt-to-GDP ratio back below 30%.

The next bump came in the 1980’s under the Reagan era, and his policies centered around Reaganomics. His era of policies led to another massive increase in the national debt, up to a ratio of 64%. The country and both parties woke up and realized the financial state of the nation was anything but stable. President Bill Clinton came into office and under him was the last time the Debt-to-GDP ratio fell below 55%, let alone decreased substantially at all.

Since President Clinton, the debt of the United States has only continued to rise, under Presidents Bush, Obama, Trump, and now Biden. The Debt-to-GDP ratio has climbed to well over 100% for only the second time in the nation’s history, and does not look like it will be coming back down any time soon. History has shown that it takes generations of presidents to ensure a decline in the Debt-to-GDP ratio. It is also evident that irresponsible fiscal and monetary policy, along with conflicts, significantly impact and raise the overall debt.

According to The Concord Coalition, our debt has risen during times of crisis, and fell during times of stability and peace. My hope is with the ending of the war in Afghanistan, and the hopeful eventual end of the COVID-19 pandemic, that our next era of stability and peace will yield a decline of our debt.

It is imperative that we pay back our debt now, and not look to try and outgrow it with our gross domestic product alone. In short, the more debt we have, the more money we have to pay on the interest of that debt. The money we spend on interest alone is close to half of what we spend on our military, and could be used to expand our economy through education and infrastructure.

One of the only ways we can shrink our debt is to spend less or take in more revenue, neither being easy on the public. If we are to invest in our nation’s future, we need to ensure we have the money to invest.

The Concord Coalition- https://www.concordcoalition.org/

Evan Brooks is a fourth-year Business Management major with minors in Economics and Civic and Professional Leadership. EB916132@wcupa.edu