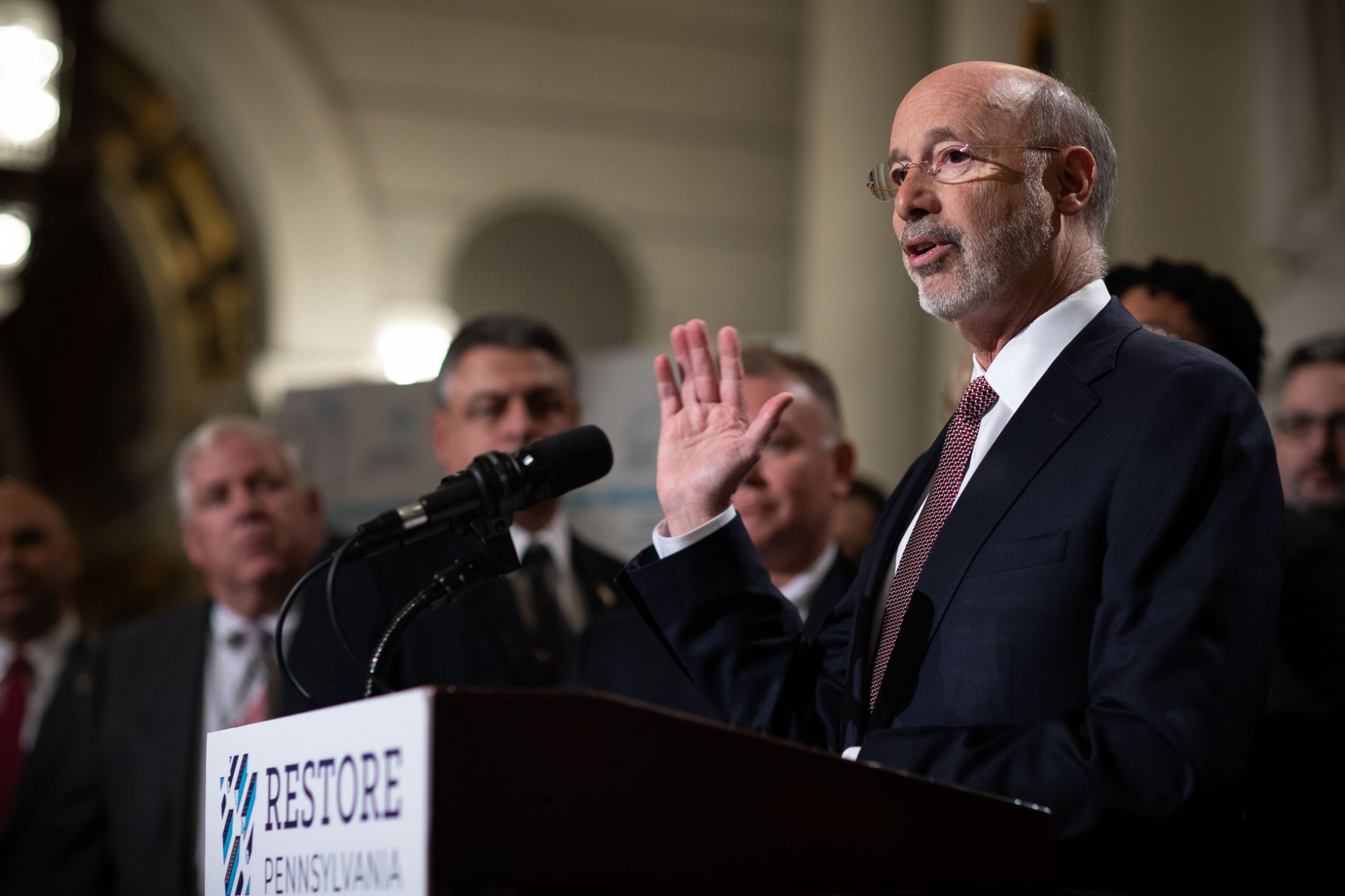

Photo via Wikimedia Commons

Even during the time of COVID-19, Gov. Tom Wolf’s budget proposal has not been forgotten. Many legislators and horse racers alike are still fighting against his proposal to use revenue directed to the Race Horse Development Fund to pay for his proposed Nellie Bly scholarship. To better understand Governor Wolf’s proposal — and its backlash — it’s important to understand how and why the horse racing industry gets revenue from casinos in the first place.

The Race Horse Development Fund was created as part of Act 71 of 2004, the Pennsylvania Race Horse Development and Gaming Act, which was created “to offset the negative impact that the legalization of slot machines would have on live racing and the state’s agricultural industry,” an explanation given by the Pennsylvania Equine Coalition in a July 2017 letter to legislators. Act 71 stated that the authorization of limited gaming “is intended to enhance live horse racing, breeding programs, entertainment and employment in this Commonwealth.”

Category 1 casinos — casinos that also host equine racing — are required to pay a percentage of their daily gross revenue, with a 12% cap, to the fund. According to the 2018 Racetrack Casino Benchmark Report, slot machines, sports wagering and table games annually generate $1.4 million in tax revenue, and about 10% of slot machine revenue was given to the RHDF in 2018. Eighty percent of the revenue is to increase purses and 4% is to fund health and pension benefits for members of the horsemen’s organizations.

For licensees that operate thoroughbred tracks, 16% is given to the Pennsylvania Breeding Fund and for standardbred tracks, the 16% is split between the Pennsylvania Sire Stakes Fund and a restricted account in the Pennsylvania Standardbred Breeders Development Trust Fund. A portion also goes directly to the State Racing Fund, as well as the restricted receipts account and promotional expense refund. In 2018, total distributions equalled $240,445,097

The gaming industry is a big source of revenue for PA, with the state being the second-highest revenue state for casino gambling in 2018. A report from the Department of Agriculture in 2010 showed that the PA racing industry’s value quadrupled after Act 71 passed.

However, the RHDF started to see their funds being diverted to other state programs. According to a report from a PA auditor in 2014, “auditors found that […] money in the Race Horse Development Fund […] is being diverted to fund other state budget expenses.” The report found that, since 2010, over $212 million was diverted from the RHDF and more than $185 million was given to the state’s general fund budget. The audit recommended “prohibiting the Department of Agriculture from using the State Racing Fund to make up for budget reductions or charging the fund for personnel expenses for time spent on work not directly related to the horse racing industry.”

In 2013, the Pennsylvania Equine Coalition reported a 4.6% decrease, or $6.36 million, in the past six months. As other casinos opened up in surrounding states, slot machine revenue at category 1 casinos began to decrease in PA. Contributions to the fund from casinos decreased from 12% in June 2010 to 10.4% in December 2012. In 2013, Gov. Wolf also proposed diverting $31 million from the fund into the state’s general fund.

The decrease in revenue and reallocation of funds prompted the passage of Act 42 of 2017, converting the RHDF into a trust fund. Section h of Act 42 states, “If any funds from the Pennsylvania Race Horse Development Trust Fund are diverted, redirected, taken or allocated for any purpose other than the purposes authorized under this section […] the General Assembly shall within 30 days of the diversion […] restore all funds that have been diverted […] from the Pennsylvania Race Horse Development Fund…”

This legislature, the opposers of Gov. Wolf’s budget proposal suggests that it stops Gov. Wolf from reallocating funds to the Nellie Bly scholarship without a legal change in wording. It also states that the funds are not the Commonwealth’s and that the “Commonwealth shall not be rightfully entitled to any money” in the RHDTF.

However, “While Wolf’s proposal is not legally viable, it poses immediate and irreparable financial harm to PA breeders by calling into question the long-term viability and fiscal security of the state’s breeding program,” says the Pennsylvania Thoroughbred Horsemen’s Association. According to an overview of the RHDTF by the PTHA, the trust fund created economic certainty and had an “immediate positive impact” that spurred new business opportunities, including a $5 million investment to create the Silver Springs Ranch, a racehorse training facility spanning 76 acres.

Despite the 2017 legislature and its economic impact on the agriculture industry, some are wary of the trust fund, which gets more state money than some state departments. Supporters of Wolf’s proposal cite the fact that the money given to the RHDTF is a subsidy from slot machine taxes, which could be put to use elsewhere.

The consistent stream of money, the Philadelphia Inquirer says, is given to a steadily declining industry in PA. The article says, “The $239 million given to the horse industry last year was larger than the entire budgets of several state departments. The Department of Agriculture operated with a budget of $143 million; the state Department of Health spent $215 million.” Additionally, 50% of race purses go to owners and corporations in other states. The Inquirer says, the largest of the purses — which can reach $1 million a race at the Pennsylvania Derby at Parx in Bensalem — are routinely scooped up by Arab princes, Hollywood moguls, and California businesspeople.”

Whether or not Wolf’s proposal will be passed is to be determined.

Alison Roller is a fourth-year English major with a minor in journalism. AR875447@wcupa.edu